Why JD.com Entered Food Delivery — and Whether the Strategy Can Pay Off

A strategic move into instant retail or an uphill battle for user mindshare? Here’s how to think about JD’s delivery play from an investor’s perspective.

JD’s Food Delivery Adventure

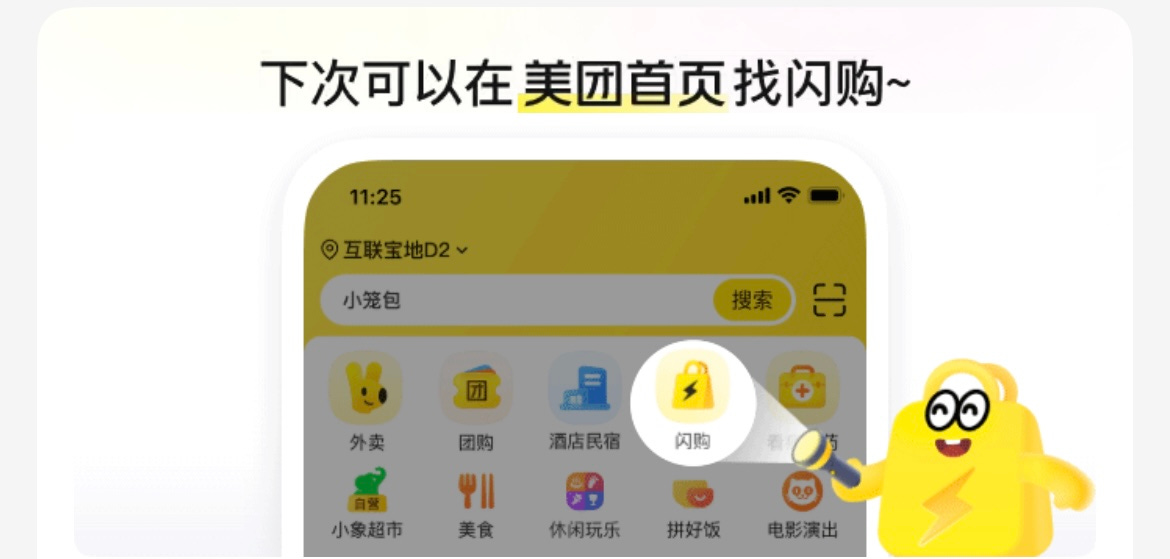

I’ve written extensively about e-commerce, delivery models, and logistics networks, so it wasn’t exactly shocking when JD decided to enter the food delivery market. JD felt threatened by Meituan’s foray into instant retail, known as Meituan Shangou (美团闪购) or “Flash Buy.”

From what I heard, JD’s move into food delivery wasn’t just about competing head-to-head — it was a strategic push to increase user frequency, an area where JD lags behind other players in China. Lately, I’ve been getting so many questions about this that I figured it would be easier to put everything into a short update — backed by a little on-the-ground research.

I was traveling recently to several cities and also teamed up with friends across more provinces and cities to compare JD’s delivery service with that of Meituan and Ele.me. We were able to check quite a number of different orders, since you don’t even have to place an order — the delivery fee is already visible before checkout. But of course, we also placed several real orders to compare delivery speed and a few other details.

On the streets, Meituan drivers are everywhere — the city is practically covered in yellow. JD drivers, on the other hand, are rarely seen. But don’t be fooled: most JD deliveries are currently handled by independent riders without any JD branding.

The findings? Well, they basically confirm what others have already observed and reported. Even though our sample size is small — so take this with a grain of salt — it’s still promising that our observations match earlier reports. It might offer a useful glimpse into what JD is up against as it tries to muscle its way into a very mature, very crowded market.

Pricing: Cheaper, But Not Always

Arriving late to the food delivery party, JD has to undercut the incumbents. On average, JD’s delivery prices were the lowest — but only on average. There were still plenty of cases where Meituan or Ele.me were cheaper on specific items or orders. So while JD is leaning heavily on price as a weapon, it isn’t offering blanket discounts across the board.

One positive for JD investors: the discounts appear focused and strategic, showing some discipline. But how sustainable this approach is remains an open question. Without visibility into unit economics or customer cohorts, it’s hard to tell whether they are building real loyalty or simply burning cash to temporarily boost GMV.

JD: Fast, But at What Cost?

(Sorry, but I couldn’t resist asking — at what cost? It’s the counter-argument you hear everywhere these days whenever it comes to anything China related.)

JD sometimes beat Meituan (and Ele.me) in delivery speed. This triumph came with an important asterisk: We observed that Meituan’s density is so high that a single rider often delivers several orders along the way, slightly slowing down individual deliveries. When we ordered from the same restaurant, Meituan’s riders often had more stops than JD’s lone hero dashing straight to our doorstep.

It’s the classic scale effect advantage of Meituan. They still usually deliver within 30 minutes but sacrifice a few minutes per delivery to save massively on aggregate operating costs. JD, with fewer orders, is faster for now — but that’s not necessarily a good thing.

In the premium section, I’ll walk through what JD is really up against:

Why user habits in food delivery are stickier than many assume

How Meituan and Ele.me built structural advantages that JD cannot easily replicate

Why JD’s moral positioning may appeal socially but struggle economically

What we can learn from Delivery Hero’s hard-earned lessons in other markets

And finally, how investors should think about JD’s endgame: is this just another price war, or a deeper play for survival in the era of instant retail?

Other article you might like

JD’s Structural Problems: No Easy Wins