China’s Food Delivery War

Why Meituan thrives While Ele.ma Struggles and JD is just faking it.

Introduction: Scaling laws

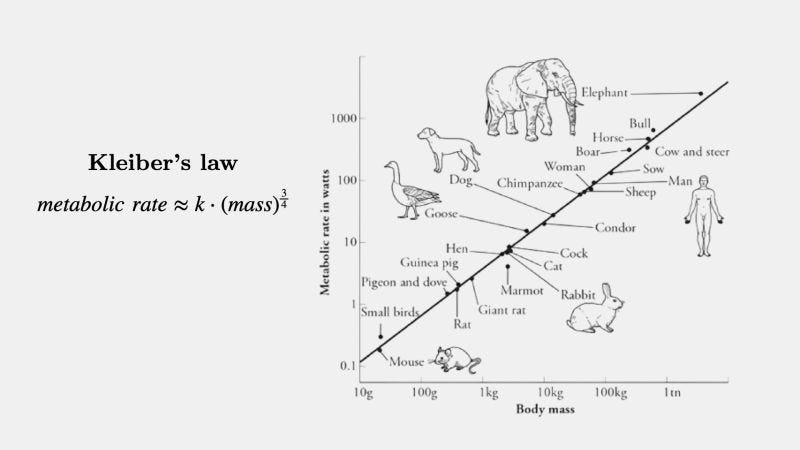

In biological systems, the relationship between size and efficiency follows mathematical patterns so universal they border on physical law. For example, Kleiber’s Law suggests that, as animals (or even human beings) grow larger, they become more efficient in terms of energy consumption. Specifically, energy usage scales with body mass raised to the power of ¾.

This means that larger organisms tend to consume energy at a slower rate relative to their size, becoming more efficient as they grow. Cities, too, obey scaling principles: as populations grow, socioeconomic outputs like wages and innovation scale superlinearly (faster than linear), while infrastructure costs rise sublinearly (slower than linear). These principles reveal a truth: scale is not just a number—it’s a fundamental determinant of survival.

Chinese food delivery war

Nowhere is this more evident than in China’s $150 billion food delivery industry, where two giants—Meituan and Ele.ma—are locked in a battle driven not by flashy marketing slogans, but by the cold, hard mathematics of scaling. Meituan, commanding over 60% of the market, has long been profitable—perhaps even more than their filings would suggest, as they continue to burn money on new initiatives. Meanwhile, Ele.ma keeps hemorrhaging cash. The difference isn’t a matter of luck. It’s scale.

The Metabolic Rate of a Delivery Platform

In biology, an organism’s metabolic rate determines how efficiently it converts resources into energy. For food delivery platforms, the equivalent is the cost per order—a metric shaped by three scaling factors:

Network Density (Restaurants + Users + Riders)

Data-Driven Logistics (AI routing, order batching)

Ecosystem Integration (cross-selling, retention)

Like cells in an organism, these components interact in nonlinear ways. Meituan’s dominance in 2,800 Chinese cities gives it a critical advantage: its network is so dense that riders can fulfill multiple orders per trip, slashing delivery costs. In contrast, Ele.ma’s sparser user base outside tier-1 cities forces riders to travel farther per order, eroding margins.

Scaling Law #1: Delivery costs scale sublinearly with order density

Meituan processes 50 million daily orders—double Ele.ma’s volume. With more orders per square kilometer, its riders achieve economies of scale per delivery. Analysts estimate Meituan’s cost per delivery at $0.80 versus Ele.ma’s $1.20. Over billions of annual orders, this gap becomes existential.

Scaling Law #2: Operational efficiency scales superlinearly with data input.

Research shows cities grow more innovative as they expand because interactions between people scale superlinearly. Similarly, Meituan’s data pool—fueled by its scale—acts as a force multiplier. Its AI algorithms optimize delivery routes in real-time, predict order surges, and even nudge restaurants to pre-prep meals. The system learns faster because it has more data to chew on.

Meituan’s logistics system processes 2.9 billion route calculations per hour. Its AI reduces average delivery times by 30% compared to Ele.ma, whose smaller dataset limits predictive accuracy. This creates a feedback loop: faster deliveries attract more users, which feeds more data back into the system.

Ele.ma, despite Alibaba’s deep pockets, struggles to compete. Its AI tools are hamstrung by lower order volume and a narrower merchant network. Even Alibaba’s financial subsidies—$1.5 billion poured into Ele.ma in 2022—can’t compensate for this structural deficit.

Scaling Law #3: Profitability scales superlinearly with ecosystem breadth

Cities thrive by diversifying industries; platforms thrive by diversifying services. Meituan has evolved from food delivery into a super app offering bike-sharing, hotel bookings, and grocery delivery. This ecosystem keeps users engaged longer, reducing customer acquisition costs (CAC) and increasing lifetime value (LTV).

Over 70% of Meituan’s users access three or more services on its app. Its CAC is 40% lower than Ele.ma’s, which relies heavily on subsidies to lure users from Alibaba’s e-commerce platforms. Worse for Ele.ma, Alibaba’s recent restructuring has diverted resources away from its food delivery arm, leaving it starved of the synergies Meituan enjoys.

While the scaling law appears tremendously powerful, in the rest of this article, I highlight other factors we must consider, as scaling laws don’t explain everything. I also analyze JD’s entry into food delivery and ride-hailing and what it means for Meituan and Ele.ma.