Thinking Through the Offshore Drilling Setup—What Actually Matters

A look at what drives offshore value and what doesn’t

What this article covers:

Offshore drilling is one of the few sectors where supply is truly stuck and demand keeps rising. With no new deepwater rigs being built, dayrates climbing, and global energy majors locking in long-term offshore contracts, the setup is starting to look unusually compelling. Yet most market participants, including analysts, still miss the point. This isn’t about forecasting oil prices or memorizing rig specs. It’s about understanding a capital-starved cycle with extreme operating leverage and knowing what actually drives free cash flow.

Analysts and Mr. Market a Powerful Combination

I have a confession to make: I have a soft spot for sectors where Mr. Market still behaves like a manic-depressive toddler, swinging between euphoria and despair with the attention span of a goldfish. Then there are the analysts—those tireless believers in the Church of Eternal Linear Projections. No matter how violently cyclical the industry, they'll take a good quarter and forecast it straight into the stratosphere, or a bad one and bury the entire sector six feet under. Their reasoning often reminds me of that classic S. Harris cartoon.

This combination of market hysteria and analytical wishful thinking creates genuine opportunity, which is why I follow oil reasonably closely, though I only rarely invest when things are so obviously misprized.

Drill Baby Drill

Recently, I noticed two insiders in the offshore drilling business had increased their positions in Valaris VAL 0.00%↑. That caught my attention. Valaris owns and operates a fleet of offshore drilling rigs, including some of the most advanced deepwater drillships, leasing them to oil companies for exploration and production. Having read annual reports across the oil sector over the years, mostly to stay prepared in case something interesting surfaced, this felt like the moment for a closer look.

Shortly after beginning my research, I realized the topic had become something of a hot trend among investors, which usually makes me lose interest faster than a politician abandons campaign promises.

But to understand the mechanics better, I spoke with several people who clearly know the industry far better than I do. They walked me through rig names, locations, contract details, specifications. Useful context, certainly, but at some point I realized this level of detail was blurring rather than sharpening the picture.

So I returned to my usual approach: identify the two or three core drivers behind the business—what actually moves earnings and thus value—then examine whether the filings support the thesis.

I'm not an oil expert. If a thesis depends on getting some technical nuance exactly right, I have no business being involved. It has to be obvious, or it's not for me.

What Really Drives the Value

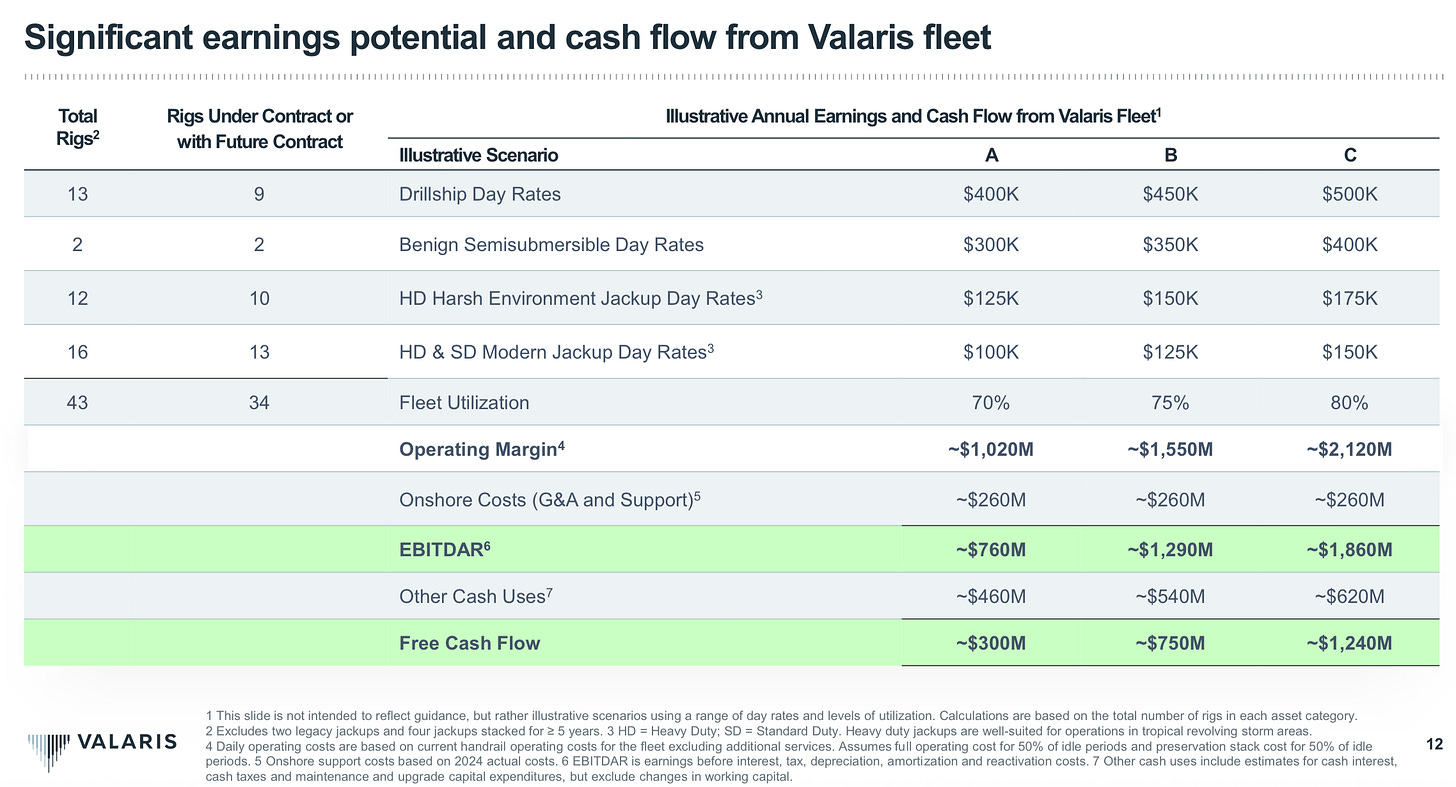

Looking at Valaris's latest investor presentation, one thing becomes immediately clear: free cash flow is almost entirely a function of two variables—dayrates and fleet utilization. They spell this out explicitly. Know what rigs are earning and how many are working, and you can get a solid handle on the cash this business generates. No need to memorize rig names like a maritime enthusiast.

There's a third factor: cost. But the picture here is equally straightforward. Offshore drillers like Valaris operate with high fixed costs. Once a rig is active, most expenses—crew, insurance, maintenance—are locked in. These companies have virtually no ability to cut costs beyond warm or cold stacking idle rigs. Zero flexibility on the cost side.

This creates extreme operating leverage. When dayrates rise, the increase flows almost entirely into free cash flow. A $50,000 per day increase in drillship dayrates, assuming steady utilization, translates directly into hundreds of millions in additional annual earnings. The same mechanism works in reverse, which explains why the downside can be so brutal when the cycle turns.

Rig Supply - What new Rig Supply?

Building a new eighth-generation deepwater drillship makes no economic sense at current pricing. Not even close. Under conservative assumptions, dayrates of at least $700,000 would be required to justify such a project, given that a new drillship now costs over $1 billion. I'll spare you the detailed mathematics—the estimate is probably too conservative anyway. But precision isn't necessary here. Dayrates currently sit below $500,000, which explains why shipbuilder order books remain empty.

Meanwhile, scrapping has continued methodically. More than 100 rigs have been permanently removed from the global floater fleet since 2014. These units are gone forever—they're not coming back like some maritime zombie apocalypse.

Cold-stacked rigs aren't a reliable source of new supply either. Reactivation requires 6 to 24 months and significant capital, typically $20 million to $100 million per rig. Contractors are extremely selective, considering only the highest-specification rigs for reactivation. The rest remain cold stacked for good reason.

The result: the effective supply of modern, competitive rigs isn't increasing. Short to medium term, it's either flat or declining. Even if someone placed a drillship order tomorrow, delivery would take years. If new supply were imminent, we'd see evidence years in advance.

Supply for drillships is capped. But what about demand for offshore drilling?

Demand: the billion dollar question

The rest is for paying subscribers.

If you’ve found this useful, consider subscribing, free or paid. If you’ve been reading for a while and haven’t upgraded, now’s a good time. Thanks for reading.

You might also find these free pieces interesting: