Meituan, JD, and Another Undisclosed Company

JD's attack, Meituan’s Churchill moment, and a few thoughts on one vastly underestimated trend. Plus a quick update on a position I’ve only shared with paying subscribers.

Meituan

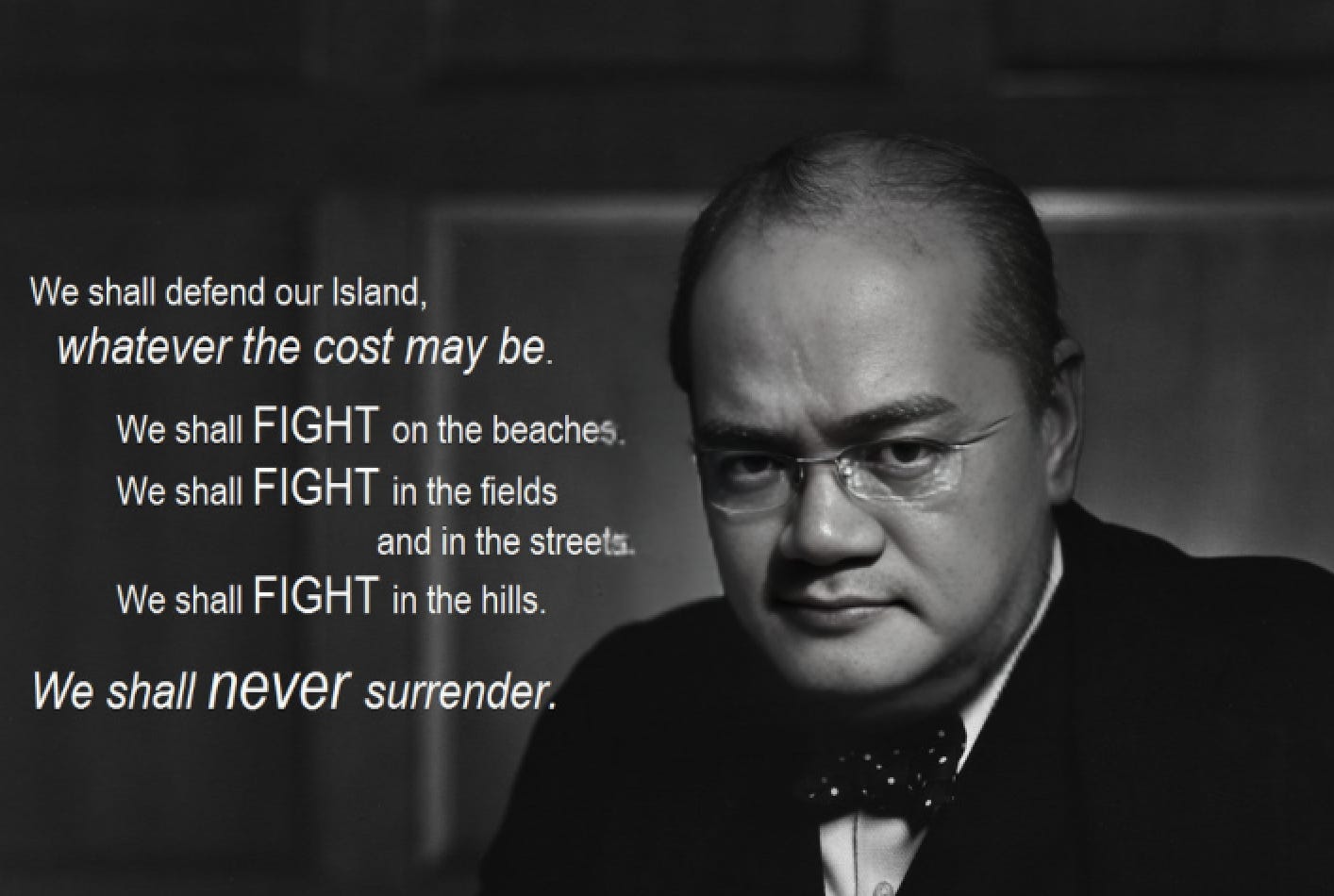

Wang Xing Goes Churchill

Revenue grew 18% year-on-year. Operating profit more than doubled, up 102%. All of that was roughly in line with expectations. Nothing shocking. But then came the first question of the call about JD entering the food delivery businesy. CEO Wang Xing lit a cigar, took a sip of his watered-down Johnny Walker Red Label, and delivered a Churchillian war speech directed at JD.

We will also increase investment in the ecosystem as committed. And as a large portion of our investment will counter revenue, we expect the year-over-year growth rate for our Core local commerce revenue in Q2 will decelerate from that of Q1, and operating profit for Core local commerce in Q2 will decrease significantly year-over-year.

We do not know how long the irrational competition from the new entrance of the market will continue. It’s impossible to give accurate financial guidance at this point for Q2 or the rest of the year, but we will continue to defend our market share.

Wang Xing Q1 2025 Earnings Call

Okay, let me make a bold guess. Investors and especially analysts will completely ignore the “decrease significantly” statement, only to act shocked and surprised in the second-quarter earnings. Just like they did with Pinduoduo last quarter.

JD’s move into food delivery wasn’t a bold strategic attack. It was a defensive move, a reaction to Meituan’s rebranding of its instant retail arm as Meituan Shangou, or InstaShopping. Meituan specifically pointed out strong sales in 3C products and small home appliances in the last quarter. Even now during 6.18, the shopping festival JD created, Meituan is aggressively advertising 3C products across all major channels.

A direct hit on JD’s long-standing strength in electronics, delivery speed and logistics. Suddenly, JD’s suburban warehouse network looks dated. Delivery within 24 hours now feels like waiting for a bus that doesn’t come.

The rise of Gen Z

As I’ve written before, instant retail is where Chinese retail is heading. The demand isn’t only coming from traditional shoppers. It’s being driven by Gen Z, born after 1995, now entering the workforce with growing spending power. They didn’t grow up shopping in supermarkets, they grew up clicking. Three-day delivery? Unthinkable. Unless there’s a massive price gap, they won’t wait. Not because they’re impatient, but because they don’t see any reason to.

The rise of Gen Z is a major theme in China. It’s not on the minds of many investors, but it should be. Similar to the rise of lower tier cities. Another interesting company in this space is Bilibili, which is now beginning to monetize the growing spending power of its Gen Z users.

As Gen Z+ users mature and their spending power increases, many are turning to Bilibili with real purchase intent, looking for trusted, unbiased recommendations.

Bilibili Q1 2025 Earnings Call

From Food to Services

Meituan started pushing hard into local services, massages, facials, minor healthcare, tutoring, even piano lessons. All discoverable, bookable, and wrapped into the same addictive ecosystem that already feeds you lunch.

Meituan moves users from dumplings to dermatologists without them ever leaving the app, while giving smaller merchants, the kind of places that used to survive on foot traffic and auntie gossip, a real shot at being found. It’s the digitization of China’s street-corner economy.

International Expansion

Internationally, Meituan claims that they are making breakthroughs. In Hong Kong, Deliveroo has already been forced out of the market. They gave up. But of course, Hong Kong is still China. So things are, at least to some extent, familiar.

Now they’re expanding into Saudi Arabia and Brazil. And that’s where it gets complicated. Not because they lack the tech. Meituan has the platform, the routing, the backend. That part scales fine. But food delivery isn’t a tech problem. It’s a labor problem. Tens of thousands of riders following instructions, showing up on time, and doing it without constant supervision. That level of discipline can be built in China. Whether it transfers to Jeddah or São Paulo is a different story.

Same for Luckin Coffee. Their edge has never been the coffee. It’s the system. Fast, standardized, ruthlessly efficient. Coffee as supply chain. Now that they will open their first US store, the only question is not taste but whether Manhattan workers will punch in at six, move quickly, and keep the caffeine factory humming at Luckin speeds.

That’s the pattern. Chinese companies can export software. What they can’t export (yet) is labor culture. And until they figure that out, I am skeptical. I’m less worried about them having to fight local incumbents when they expand abroad, because Chinese companies are battle-hardened, perhaps more so than their foreign counterparts. The problem isn’t competition. It’s compliance—of the human kind.

Beijing’s Invisible Hand: Everyone Is Suddenly Talking About ‘Support’

With the economy sputtering, Beijing’s pressure is unmistakable. Meituan, like everyone else, is suddenly all about merchant support, empowerment programs, and loving the little guy. The auto sector was just ordered to pay small suppliers within 60 days. Something heavy is moving in the background. Meituan’s just following the script.

In the rest of this piece, I review JD’s latest earnings and look at their entry into food delivery. What’s behind it and whether it’s likely to work. I’ll also cover another company I’ve been following closely, which I’ve only shared with paying subscribers so far.

If you’d like access to the full piece, consider subscribing. It genuinely supports my work and helps keep me motivated to keep writing.

JD