Kuaishou - leading in AI, growing operating profit by 150+%, trading at EV/FCF of 4.6

Why the Market Is Overlooking Kuaishou’s Hidden Growth Potential

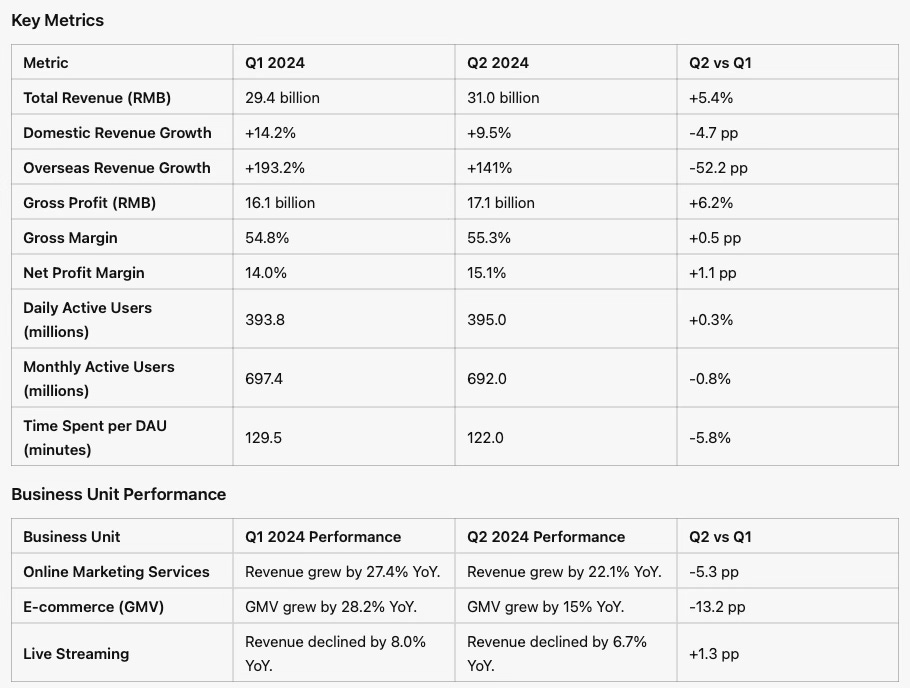

Kuaishou Performance Overview: Q1 vs. Q2 2024

In my earlier articles, I provided an in-depth introduction to Kuaishou, which you can find here (part 1) and here (part 2). Today, I’ll update you on Kuaishou’s performance in the last two quarters, providing a side-by-side comparison to highlight the company’s recent developments.

After the very strong first quarter where Kuaishou’s stock peaked at 60 Hong Kong dollars, the company faced significant challenges in the second quarter. The entire Chinese retail sector, including e-commerce, struggled during this period due to notably weak consumer spending. Rumors circulated about weak GMV growth during the 618 shopping festival were confirmed once the company released its earnings, leading to another 10% drop in stock price to below 40 Hong Kong dollars.

Later on, it was revealed that the rumors were actually the result of an employee leaking sensitive internal information, including core company data and strategic plans, and earning 700,000 RMB from the breach. This type of incident is not uncommon; both Tencent and ByteDance have faced similar issues in the past. I have written more about it here.

Concerns

Decline in MAUs: Despite a 18% year-over-year increase in customer acquisition spending, Monthly Active Users (MAUs) are declining, raising concerns about user retention.

Increased Sales and Marketing Costs: Sales and marketing expenses rose to 10 billion yuan, pushing the expense ratio to 32.4%, well above the 10-20% range seen in more mature companies. This raises concerns about the platform’s ability to retain users without heavy promotion.

Customer Stickiness Concerns: The high sales and marketing rate suggests issues with user stickiness. The inability to lower marketing expenses raises questions about Kuaishou’s capacity to sustain user engagement organically. This also raises the question of how many users are coming from Tencent, given their extensive marketing collaboration.

Tencent’s role: While Tencent is an investor in Kuaishou, they are simultaneously developing their own stand-alone short video platform. We’ve seen in the past (e.g. Sogou) that Tencent tends to take an indifferent approach, investing in external companies while also developing similar products in-house to see which succeeds. This poses a significant risk for Kuaishou, as they face competition not only from other platforms but potentially from Tencent itself.

Live Streaming Revenue Decline: Live streaming revenue declined by 6.7% in Q2 2024, highlighting the challenges in this segment. One contributing factor is Kuaishou’s strategic shift towards smaller and mid-tier KOLs, which is causing short-term difficulties but is expected to be beneficial in the long run. The entire Chinese live streaming sector has been under pressure due to government intervention. However, moving forward, they will face easier comparables, which could help either reduce their declines or even return to growth.

Weak GMV Growth: GMV growth slowed to 15% from 28.2% last quarter, despite an extended 618 festival. The absence of top streamers like Sinba contributed to this weak performance; however, Sinba’s contribution to GMV has been marginal recently, and they have now completely banned him from their platform.

Shelf-Based E-commerce Lagging: Kuaishou’s shelf-based e-commerce, while accounting for over 25% of GMV, lags behind Douyin’s 40%, increasing dependency on live streaming KOLs.

Opportunities

Strong Online Advertising Growth: Kuaishou’s online advertising grew by 22%, outpacing the industry’s 18%. Advanced AI integration should continue to drive efficiency, sustain growth, and gain market share. At the same time, BIDU 0.00%↑ Baidu is massively underperforming in the ad space.

E-commerce Take Rate: Despite weaker GMV growth, the e-commerce take rate increased to 1.36%, with revenue growing by 21.3%, indicating effective monetization.

Cost Reduction: Other costs are decreasing due to reduced profit sharing, bandwidth optimization, and amortization of intangible assets, demonstrating some cost discipline amid challenges.

Market Dominance: Kuaishou remains dominant in lower-tier cities, which are expected to be the primary growth driver in China going forward. A point still underestimated by many investors. However, it is important to note that people in these areas have lower spending power compared to those in first-tier cities.

User Engagement: The ratio of daily active users to monthly active users is increasing, which is a positive sign of stronger user engagement. This is a general phenomenon happening across China, where user numbers have essentially reached a plateau. Many companies, if not most, have shifted from focusing on growing their user base to engaging existing users more deeply.

New Initiatives: The partnership with Meituan to target local life services could open new growth avenues, as advertisement spending in this segment increased by over 60% year-over-year. For more details, see here.

Share Repurchase Program: In the first quarter, Kuaishou introduced a share repurchase program worth 16 billion Hong Kong dollars, which represents roughly 10% of shares outstanding at the current market valuation.

Advancements in AI: Kuaishou has made significant strides in AI, releasing their Sora-like text-to-video generating AI, which has shown impressive results, see here and here for an examples I created. Recently, they upgraded their new Kling 1.5 model with impressive results. This technology is already being used for marketing, as well as short video and short movie production, and will likely enhance their content creation capabilities.

Investor day September 13

Here are my notes of the Kuaishou’s investor day.

E-commerce: The pressure on average transaction prices has caused a short-term slowdown in the e-commerce business growth.

Commercialization: Internal circulation advertising efficiency continues to improve. Active internal circulation customers increased by 80% YoY in 1H24, and the monetization rate improved by 7% YoY. External circulation advertising shows resilient growth due to increasing demand in industries such as short dramas, mini-games, and novels.

Financial Goals: Kuaishou aims to achieve the “40 Rule” (core business revenue growth rate and adjusted net profit margin both >20%). Gross profit margin improvements (up to 60%) and optimized sales expenses (sales expense ratio down to 30%) are expected to push the adjusted net profit margin to over 20% in the future.

Live-Streaming E-commerce: The platform’s GPM of live-streaming e-commerce in the public domain grew by 18% YoY in 2Q24. Influencer-driven daily GMV increased by nearly 90% from 4Q23. Shelf-based GMV also grew by over 55% YoY, with monthly active consumers up by 40%.

Short Dramas and Mini-Games: Kuaishou has over 40 million paying short drama users and 37 million mini-game MAUs, with strong advertising demand from both sectors.

Video Generation: Kuaishou’s Ke Ling, the world’s first real-image-level video generation model, has accumulated 2.6 million users and generated 27 million videos.

Overseas Business: Kuaishou is focusing on the Brazilian market, aiming to break even through advertising commercialization. It plans to explore e-commerce and financial services for long-term growth. Elsewhere, the company operates at low cost, awaiting development opportunities.

Local Life Business: Local life GMV grew by 296% YoY, with monthly active transaction users up by 278% YoY. Kuaishou will focus on expanding GMV and improving monetization rates, targeting profitability by city by 2025.

Valuation and outlook:

Despite the challenges I’ve outlined, including weak Chinese consumer spending and intense competition from ByteDance and Tencent, Kuaishou currently trades at an enterprise value to free cash flow of only 4.6. They maintain a strong balance sheet with around 20% of their market cap in net cash. Operating leverage is also improving, and they are on track to increase operating profit by 150% this year.

If their investor day guidance is even remotely accurate, Kuaishou appears to be very undervalued. They project gross profit margins rising to 60%, sales expenses decreasing to 30%, and a net profit margin exceeding 20%.

what were their issues with Xinba