Not Sure How to Think About Recent Chinese Policies?

Here’s the mental model I use to understand the dynamics of Chinese policy shifts and their broader impact on society and the market

Introduction

In this article, I’m going to present a very simple mental model that I’ve found helpful for understanding Chinese policymaking. This will serve as the foundation for another article, where I’ll dive into a specific industry and explore how policy shifts could benefit it—something many investors haven’t yet recognized. So stay tuned for the second part!

I’m not going to dive into extensive background or details—that’s beyond the scope of what I want to cover today. Instead, I’ll focus on presenting this model as a straightforward and useful tool for thinking about how policies in China operate.

The Chinese Development in the Last 50 Years

The development in China over the last 50 years has been truly remarkable. One of the key reasons for this success is that the government has the capability and power to make drastic changes and push them through quickly. When they set a course, they can implement it without the roadblocks seen in other countries, where endless lawsuits or bureaucracy can delay projects, such as infrastructure, for decades.

For example, if a homeowner refuses the usually generous compensation offered for giving up their house for an infrastructure project, they might end up with a so-called “nail house”.

The Pendulum Swing Model

As I mentioned, the key advantage of the Chinese government is its ability to make rapid and drastic adjustments. Sometimes, however, they hold on to previously successful policies for too long, which can create problems.

The way I think about Chinese policymaking is a bit like a pendulum swing. Policies are put in place, and when they are successful, the momentum builds. As the pendulum swings further, reinforcing the positive development, the policy becomes deeply ingrained in the Chinese political system, from the top down to provincial and city levels, becoming firmly established. Nobody in the system has an incentive to challenge those successful policies. This is often the point where the pendulum swings too far, overshooting the original intent of the policy.

This leads to problems on the other side of the spectrum, and usually, and usually some event arises that forces or triggers the system to self-correct. The government takes action, reverses course, and the pendulum swings back. However, it doesn’t stop at the middle but swings again to the other extreme.

That’s it—it’s as simple as that. But rather than go into more detail, let me give you some examples from the last few years.

Examples of the Pendulum Swing in Action

Air Pollution Reforms:

For years, environmental protection was not a top priority, and air pollution in Beijing, as well as across China, was often downplayed as mere “fog.” However, as public pressure grew—spurred by incidents such as the cancer diagnosis of a prominent actress—the government responded with drastic measures. The focus shifted entirely to defending Beijing’s blue skies. Factories were shut down or relocated, and coal ovens were banned. The pendulum was now in full swing back, with blue skies taking priority over economic development. It swung far to the other side, at the expense of smaller businesses.

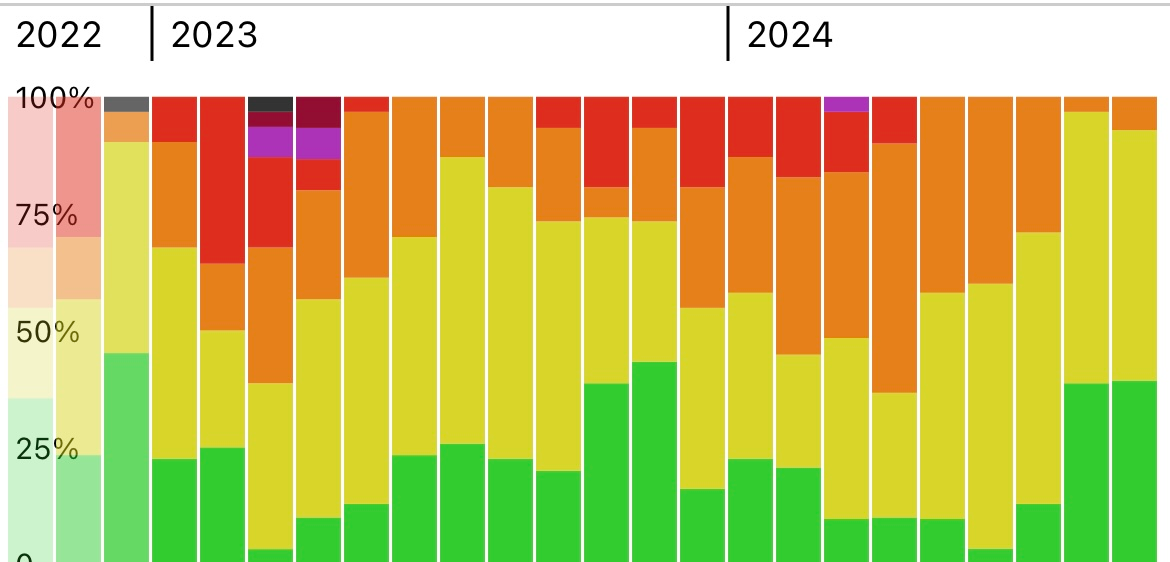

Here’s a comparison of the air quality measurements in Beijing from 2016/2017, before the new policies, and the latest readings: (If you’re not familiar with it—red means bad, purple is unbearable, and brown means you can’t see the other side of the road. The high readings in 2023 were due to sandstorms rather than industrial air pollution.)

Stock Market – Baijiu Makers:

Baijiu companies like Moutai and Wuliangye were top-performing blue chip stocks. However, in 2013/2014, the government’s crackdown on corruption hit them hard, leading to stock price declines of over 50%, and they began trading at very low multiples.

But after the crackdown ended and the issues were resolved, the pendulum swung back, allowing these companies to grow again. They were once again supported by the government, as Moutai, for example, is one of the largest sources of income in Guizhou, one of China’s poorest provinces. Since then, they have once again become some of the best-performing stocks in China, with multiples expanding 6-7x by 2021.

I could go on and discuss more examples, like Chinese tech companies, the COVID-19 policies or the abandonment of the one-child policy and declining birth rates, which led to crackdowns in education, housing, and healthcare to reduce financial burdens on families. But I think you get the point—I don’t need to elaborate further.

Conclusion

I personally find the simple mental model of the pendulum swing extremely useful when thinking about Chinese policies and their impact on the stock market. The key takeaway here is that if the pendulum is swinging against you, it’s best to take cover. However, if you find yourself on the right side of the pendulum, it can be a very powerful and rewarding place to be.

For instance, if the Chinese government announces a major crackdown on tech companies, you run for cover—you don’t buy the dip, as it can get ugly. However, once the situation changes and the pendulum swings back, it can lead to remarkable opportunities, just like with the baijiu makers in 2015.

Nice take!

Very helpful! Thanks